With the SME financing gap at an all-time high—amplified by rising costs, scarce bank loans, and a tough economic environment—24% of SMEs in the Euro area reportedly experienced severe issues accessing finance¹. Alternative lending, more mature in regions like the US and UK, is making strides, with companies like Silvr leading the charge by harnessing automation and smart data analytics.

In its innovative approach, Silvr efficiently leverages borrower data, automatically classifies it with its LLM-driven ClassifAI tool, and conducts automated credit assessments. Thus taking credit underwriting automation a step further and offering a glimpse into the future of SME lending.

This article will explore the landscape of SME lending, Silvr's underwriting evolution, and the transformative impact of automation on risk management.

SME lending: a market on the rise

The SME lending sector is experiencing profound changes as Open Banking gave lenders unparalleled access to borrower data. Within the UK's SME lending market, alternative lenders have established a notable presence, already representing 9% of it² with a CAGR of 37% between 2013 and 2021². Led in France by Silvr, the SME lending market, propelled by technological advancements, presents both opportunities and challenges for alternative lenders.

Technology has paved the way for faster loan processing, increased data accessibility, thanks to SME digitalisation and regulatory developments such as Open Banking. Cash flow based underwriting is gaining momentum thanks to its capacity for quicker, more tailored credit assessments leading to a more inclusive and efficient lending landscape.

However, the landscape is not without its obstacles. Varying data availability across regions, such as Europe benefiting from PSD2 regulation, contrasts with evolving regulations in the United States.

Integrating external data seamlessly and deriving meaningful insights require rapid experimentation. Overcoming ongoing connectivity challenges is crucial for maintaining real-time insights into customers' financial health.

Additionally, SMEs often face relatively high interest rates, further compounded by economic volatility and regulatory uncertainties. These challenges highlight the need for continued innovation and education in SME lending space to bridge the gap between technological potential and actual access to financing.

Credit assessment: cash-flow data is key

At Silvr, the evolution of scoring for SME loans showcases a dynamic shift towards leveraging bank transactions as the most actionable source for underwriting decisions.

Silvr’s initial approach involved a lot of manual processing by Risk Analysts. But instead of replicating the existing process at scale, Silvr’s underwriting approach is now combined with our risk decision tree risk decision tool to grow the automation of the risk assessment processes and iterate on credit scorecards faster.

Enriched cash flow underwriting method

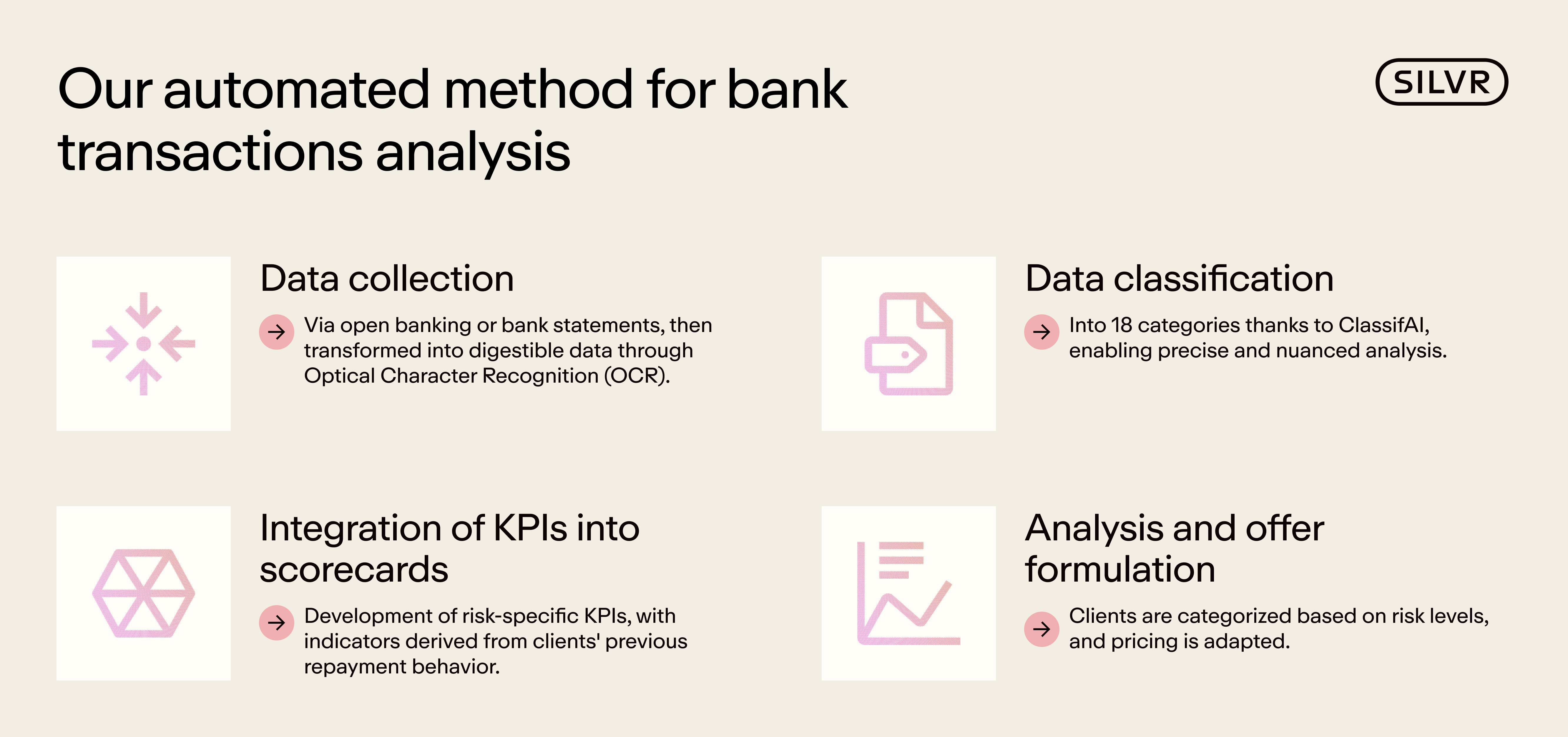

1. Data collection

Silvr harnesses the power of Open Banking and PDF bank statements for data collection covering the last few months of bank transactions. Optical Character Recognition (OCR) technology is employed to transform the bank statements into digestible financial data, integrating anti-fraud mechanisms to enhance reliability.

2. Cash flow reconstruction via Silvr ClassifAI

The cornerstone of Silvr's method is the reconstruction of cash flow, segmenting data into 18 categories through the use of ClassifAI, a machine learning tool in continuous improvement, learning from the behavior of risk analysts and company data. This AI-based classifier, trained on Silvr's proprietary dataset, including over 1 million French and German bank transactions, has achieved a classification accuracy of 95% on 15 million transactions as of February 2024. It converts raw financial transactions into contextualized data leveraging an open model developed by Google.

3. Integration of KPIs into scorecards

This contextualized data allows to create a set of risk-specifc KPIs as well as an additional layer of signals derived from client’s past repayment behaviour, which enrich Silvr’s decisioning process and are reflected in credit scorecards.

4. Analysis and offer formulation

That allows to rank potential clients based on their assessed riskiness tiers and make swift credit decisions for loan issuance. This strategic approach allows to adapt pricing and assess the financial health and quality of companies within Silvr's acquisition funnel, demonstrating a sophisticated and data-driven approach to SME lending.

Impact of automation on risk management

The automation of the cash flow underwriting process brings benefits for both SMEs and Silvr.

Improved access and enhanced service quality for SMEs

For businesses, this technological evolution has not only increased the volume of loans available to businesses but has also significantly improved the service quality. With easy and fast online applications, including KYC/B processes that take just one minute for the customer, businesses can be offered financing in 48 hours. Silvr's adaptive and customized offerings allow for instant adjustments of loan parameters, providing the most tailored proposals to each business's unique needs.

Increased revenue for Silvr

Higher acceptance rates, lower acquisition costs, and an enhanced customer experience have contributed to a substantial increase in revenue. By distinguishing more effectively between eligible and non-eligible clients, the company can offer better tailored pricing.

A time saver

The time savings are significant: what used to take 120 minutes in a manual approach or 45 minutes with Silvr's rule engine in 2021-2022, now takes only 12 seconds with ClassifAI, marking a 600x speed improvement. Efficiency gains stem from automated data extraction and automation of the credit decision engine, allowing to spend extra time on more complex cases if or when required.

Cost optimization

Initially, the manual approach incurred expenses totaling 60€. With the integration of the Silvr rule engine during 2021-2022, this expense was notably decreased to 22€. However, the most substantial cost reduction was achieved thanks to ClassifAI, incurring a mere 0.2€ in LLM call charges. Comparatively, this makes the new system 300 times cheaper when compared to the manual approach.

Conclusion

Digital players like Silvr are positioned to unlock a $5.2 trillion SME unmet opportunity³ with a state-of-the-art AI-enhanced underwriting approach . Silvr's AI technology and product have not only opened up a massive market but also demonstrated strong traction with mainstream SME customers from day one. The automation at Silvr serves a dual benefit: optimizing risk evaluation and democratizing SME loans, making financing more accessible. At Silvr, AI and data analysis transcend being mere tools; they are the foundational pillars serving the real economy, illustrating Silvr's success story in achieving its mission.

¹ The European Small Business Finance Outlook, EIF Research and Market Analysis, 2023

² Small Business Finance Market report 2023, British Business Bank

³ Small and Medium Enterprises (SMEs) Finance, The World of Bank, Oct 16, 2019